Information is at our fingertips, and artificial intelligence continually surpasses human capabilities in specific tasks; the landscape of valuable skills is evolving. According to Dr Susan David, while technical know-how remains crucial, it’s quickly becoming commoditised. As a result, the pendulum is swinging towards the intrinsic value of distinctly human skills, finding and forging moments that connect us – one human to another. Think about it. Two decades ago, coding or data analytics knowledge might have […]

Continue readingMore TagCategory: LIFE

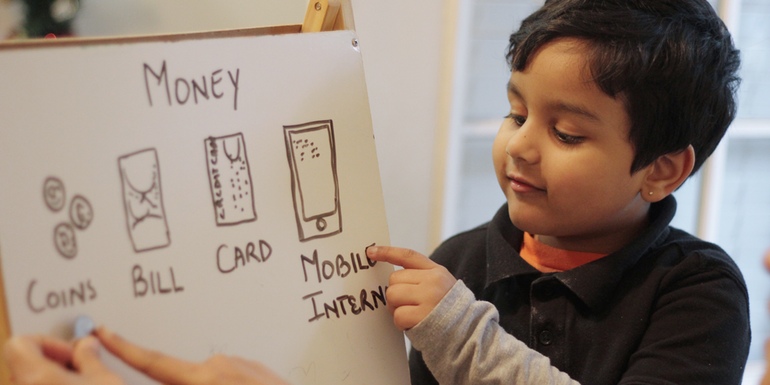

Time to think about money – Part 3

Trust is a crucial component of any successful financial relationship. Trust plays a huge role in making things work, whether it’s with your spouse, financial advisor, or business partner. And one way to build that trust is through the art of listening, which is a central idea in Nancy Kline’s Time to Think methodology. As mentioned in a recent blog, Nancy Kline is an American-born author, business consultant, and personal development coach. She is best known […]

Continue readingMore TagCreating a new financial narrative

In a few recent blogs, we’ve considered our money stories and how we can not only route out false narratives but work towards creating new financial stories. After exploring the emotional aspects of your financial health and understanding your money story, it’s time to create a new financial narrative that fosters a healthy money mindset. By actively working on your relationship with money and adopting positive habits, you can cultivate an empowering and emotionally balanced approach […]

Continue readingMore TagHow automatic thoughts shape our financial habits

Automatic thought patterns are pervasive and impactful, influencing our moods, behaviours, and even our self-concept. In our everyday lives, we sometimes struggle to recognise their presence in our decision-making, especially when it comes to financial choices. These automatic thoughts – images, words, or other mental activities – that pop into our minds in response to certain triggers can appear mundane or insignificant. Yet, they are anything but! So, what is automatic thinking? Stemming from the beliefs […]

Continue readingMore TagUnearthing the roots of your money story

Money, it is said, makes the world go around. We use it daily, exchange it for goods and services, save it for the future, worry about it, celebrate it, and yet often, we are reluctant to delve into our personal histories with it. Our earliest memories of money can reveal much about our present-day financial beliefs and behaviours. Understanding these memories is essential to retelling your money story and creating a healthier relationship with your finances. […]

Continue readingMore TagData to Wisdom for your financial journey

As we journey through life, we often hear phrases like “seeing is believing”. But when it comes to our financial health and well-being, there’s a subtle yet profound difference between merely seeing and truly recognising. It’s akin to looking at a tree and appreciating its beauty, compared to recognising its species, understanding its growth patterns, and knowing its ecological value. This difference plays a pivotal role in financial planning. ‘Seeing’ could be equated with knowing our […]

Continue readingMore TagTime to think about money – Part 2

Independent thinking is critical in lifestyle financial planning, and here’s why. Each person has unique financial needs, aspirations, and circumstances. When you think independently, you can assess your personal situation and determine what matters most to you. This helps you set goals that genuinely reflect your values and priorities, making your financial plan more meaningful and motivating. Also, the financial landscape is constantly changing. New investment opportunities, tax laws, and market conditions emerge all the time. […]

Continue readingMore TagMore about your money story

Money is more than just a tool for transactions; it’s an emotional force intertwined with our identities, values, and sense of self-worth. Our money story is a tapestry of beliefs and experiences that shape our financial behaviours and attitudes. By exploring different elements of our money story, we can better understand our emotional connection to finances and work towards a healthier relationship with money. Financial Role Models: Our money story is greatly influenced by the role […]

Continue readingMore TagInvesting with Heart and Mind

Embarking on and sticking to your investment journey requires a solid understanding of financial principles and an appreciation for the emotional roller coaster that comes with it. Asset allocation, a crucial component of investing, is about striking the right balance between risk and reward to achieve your financial goals. As you consider different allocations, it’s essential to recognise the emotional implications of your choices, allowing you to make informed decisions that align with your unique risk […]

Continue readingMore TagTime to think about money – Part 1

Discussing finances can be a daunting task, especially when emotions run high. It’s important to remember that there’s a human element behind every financial decision – our dreams, fears, and values. Nancy Kline is an American-born author, business consultant, and personal development coach. She is best known for her Time to Think methodology, which emphasises the importance of creating a thinking environment that promotes independent thinking, deep reflection, and transformative change. By incorporating Nancy Kline’s Time […]

Continue readingMore Tag