Many young people neglect to plan for their retirement during their early working lives, arguing that they will take care of it later in life when they are earning a bigger salary. However, on the flip side of the coin, as people get older they assume that they must rebalance their portfolios into more conservative investments. Luckily, most people are choosing to retire later in life. If you have left investing in your retirement until later […]

Continue readingMore TagCategory: Blog

Spoil mom – prepare early!

Get ready to blow her hair back – don’t just wait for it to happen! The trick to spoiling mom is not in buying the perfect present, but making sure you’ve thought of all the little details – and this takes preparation. This is a woman who devotes every detail to you, so showing her that in return – is a perfect way to spoil her! The best place to start is to keep it simple! […]

Continue readingMore TagFinancial Fortifications for Forty Somethings

It’s often said that the best years are the forties – and for so many reasons! Whilst everyone is different, it’s good to state at the start of this article that this perspective is becoming even more prevalent. Some forty year-olds are in their first marriage with kids, others are in their second or third… with kids. Some have never been married and have no inclination of doing so. These situations place people in very different […]

Continue readingMore TagDrawing up a Budget – Useful Tips

Nowadays, making a transaction can feel somewhat unreal. Just a swipe and a glance at the number displayed on a digital screen. Whilst this seems easy and practical, it poses a big problem that is too-often overlooked. When we stop dealing with physical coins and notes – a mental disconnect occurs between the digital numbers and what they actually mean to you in terms of how much money you have just spent, and how much you […]

Continue readingMore TagCommon financial mistakes in your thirties

Saving in your thirties becomes increasingly difficult as your financial responsibilities increase. However, sound financial decisions during this phase of life can have profound benefits at a later stage. Here are some common financial mistakes to avoid: The first is failing to draw up a budget. A proper budget is the starting point of all financial discipline and should be physically written down for later reference. Include your partner in this process as it is important […]

Continue readingMore TagCards for kids | Teaching your child to manage a credit card

Basic financial learning curves are best learnt early in life, they will benefit you in your youth as well as in the future. Managing debt is one such important learning curve and a credit card is a transactional tool through which this experience can be gained. The sooner you teach your children to be disciplined in handling a credit card, such as paying back debt and controlling the associated interest and fees, the better. This can […]

Continue readingMore TagSouth Africans lack confidence when it comes to finances

Most South African consumers feel challenged by their finances, with relatively few saying that they are highly successful at sticking to their financial goals or are knowledgeable about financial matters.This was revealed when the Financial Planning Institute of Southern Africa (FPI) conducted a nationwide survey, in conjunction with the Financial Planning Standards Board (FPSB) and a global research firm (GfK), to determine South African citizen’s financial attitude compared to that of the average global citizen.Both primary […]

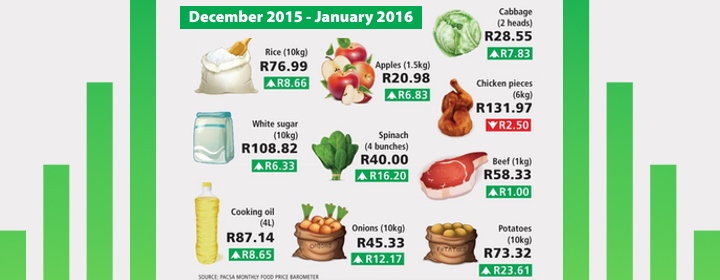

Continue readingMore TagFood costs eating through our pockets

Certain provinces have been struggling to keep up with the skyrocketing cost of food. Current data points to an agriculture industry that is struggling, mainly due to the diminished buying power of the rand and a prolonged drought.November 2015 saw the worst drought in South Africa in 23 years. During this time Stats SA released figures showing three consecutive quarters of steep decline in agricultural activity, forcing South Africa to import maize to make up for […]

Continue readingMore TagRetirement doesn’t happen at 65…

Retirement planning is only one component of a holistic financial plan and although retirement has a higher probability than all the other risk areas, this is the area we find people being the worst prepared for. Retirement doesn’t happen at 65… it happens when you make it happen!Planning for retirement is much like planning a flight in a light aircraft. Before you embark on this journey you have to check if your aircraft is in a […]

Continue readingMore TagRetail Distribution Review – Prepare for advice fees

For the first time in South Africa, financial advice is set to become a billable service. Known as the Retail Distribution Review (RDR), the first phase will be implemented later this year (2016), introducing some significant changes for both consumers and financial advisors alike.As with all change, some sound preparation and a positive outlook will make for a smoother adjustment. One of the main changes in mindset is to accept that making direct payment for financial […]

Continue readingMore Tag