Nowadays, making a transaction can feel somewhat unreal. Just a swipe and a glance at the number displayed on a digital screen. Whilst this seems easy and practical, it poses a big problem that is too-often overlooked. When we stop dealing with physical coins and notes – a mental disconnect occurs between the digital numbers and what they actually mean to you in terms of how much money you have just spent, and how much you […]

Continue readingCommon financial mistakes in your thirties

Saving in your thirties becomes increasingly difficult as your financial responsibilities increase. However, sound financial decisions during this phase of life can have profound benefits at a later stage. Here are some common financial mistakes to avoid: The first is failing to draw up a budget. A proper budget is the starting point of all financial discipline and should be physically written down for later reference. Include your partner in this process as it is important […]

Continue readingCards for kids | Teaching your child to manage a credit card

South Africans lack confidence when it comes to finances

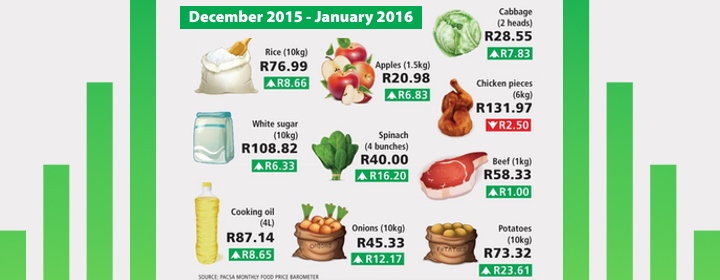

Food costs eating through our pockets

Retirement doesn’t happen at 65…

Retail Distribution Review – Prepare for advice fees

For the first time in South Africa, financial advice is set to become a billable service. Known as the Retail Distribution Review (RDR), the first phase will be implemented later this year (2016), introducing some significant changes for both consumers and financial advisors alike. As with all change, some sound preparation and a positive outlook will make for a smoother adjustment. One of the main changes in mindset is to accept that making direct payment for […]

Continue reading