How do you decide on the better of two products you are not really familiar with or can’t visually tell the difference?

For example – I had to buy a new cellphone charger the other day, and there were two options – one was two-thirds the price of the other, but both were reasonably priced (according to my limited experience of buying chargers!).

I went with the more expensive one because the price tag convinced me that it would be the better choice. If I knew the industry, I would probably know that they were both made in the same factory in some far-off land – but the higher price convinced me of higher value.

You’d probably do the same. It’s the same with buying a car, paying for food at a restaurant, purchasing new shoes and just about everything else that we pay for. Price skews our perception of value.

It’s also the same for investment fees. Sometimes we can assume that the higher the fee, the better the return.

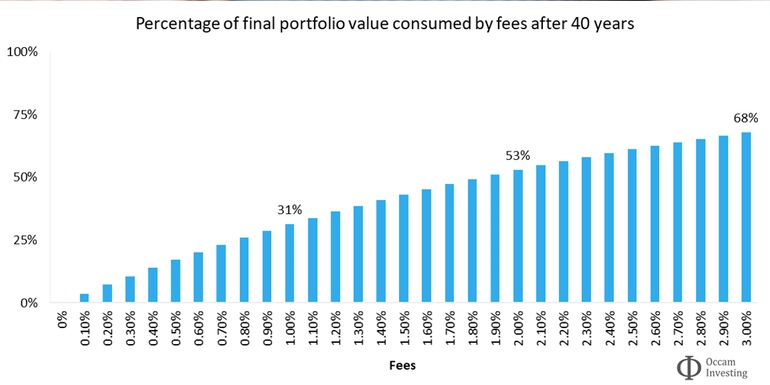

But – as we can see in the graph above, this is not the case for long-term investment strategies. Over time, fees can erode over 60% of our final portfolio value. That’s why, when it comes to hard and fast rules for fees and certainty in investing – they simply don’t exist.

However, we can say that in most cases, lower fees lead to higher returns.

As Occam Investing wrote in a recent blog, “There are no such things as laws in investing.”

When it comes to markets, we can never share the same level of certainty as we do in Newton’s laws of motion.

Trying to prove something in investing is like Newton trying to prove gravity exists in a world where sometimes things are pulled towards each other, sometimes they aren’t, sometimes the opposite happens, and sometimes something invisible comes out of nowhere and throws everything around a bit.

To make matters even more difficult, the environment in which we’re operating is always changing. Newton was able to prove gravity existed because the laws of physics never changed – he was able to run experiments while keeping everything else constant. But markets are always changing.

Investors can never really be sure of anything – we’re left to make the best of unprovable theories and confidence levels while navigating an environment in constant flux. But no matter how much changes in markets, no matter how many theories you choose to place confidence in, one thing will remain true regardless of approach.

All else equal, lower fees will result in better performance.

And although all else isn’t always equal, both the theory and the evidence show that the best and most consistent way to increase returns is to reduce fees.

This is a powerful conclusion for investors. While so much of what happens during our investing lifetime is outside our control, how much we pay for our investments is very much inside our control.

Given that the amount paid in fees is a great predictor of performance in investing, focussing on reducing fees is the most reliable way investors have to increase their odds of investing successfully.